Boost Your Trading Results

with Better, Smarter ODDS.

When it comes to options trading, probability is money. And no one does probability better than ODDS.

"In essence, all trading decisions are based on the laws of probability..."

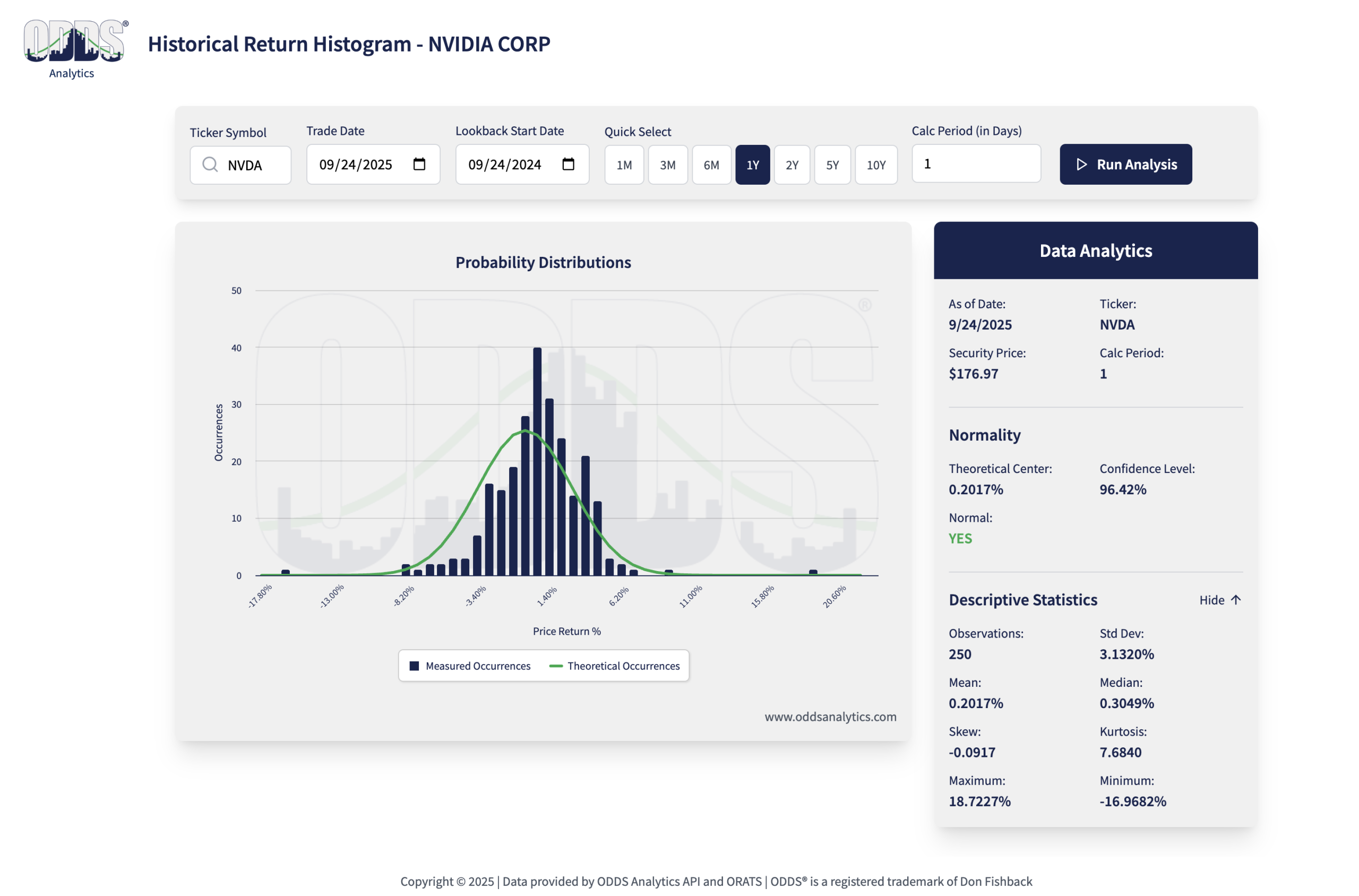

ODDS Analytics Lets You See Probability That's Real.

"ODDS is the very first step in an intensive training process each of my traders must complete. ODDS teaches my traders the real meaning of volatility and it gives them the tools to calculate probability. It gives them the knowledge they must have in order to progress."

Jon Najarian, US Options Lifetime Contribution Award Winner

Try ODDS Analytics for free. No credit card required, no software to install.

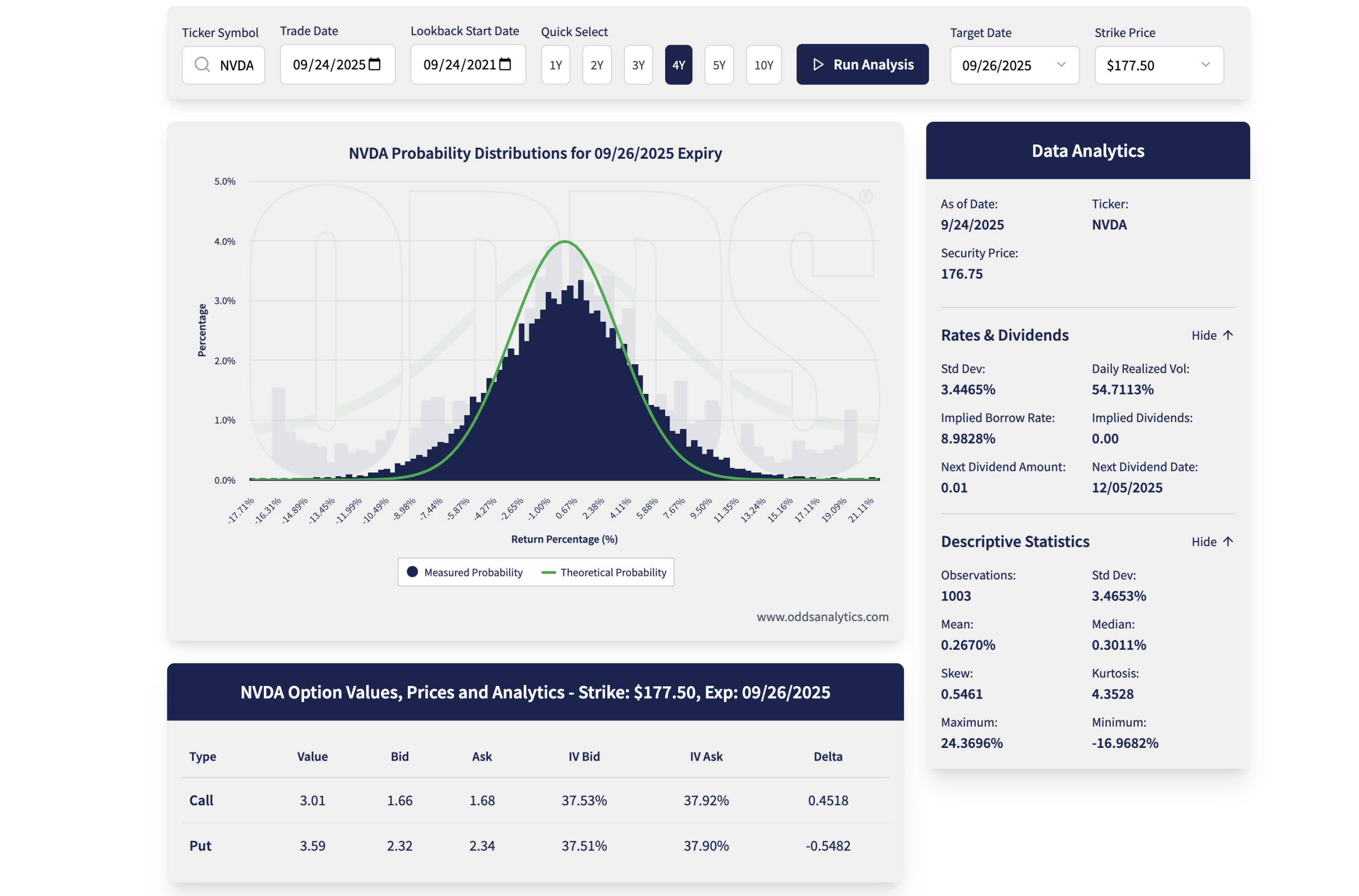

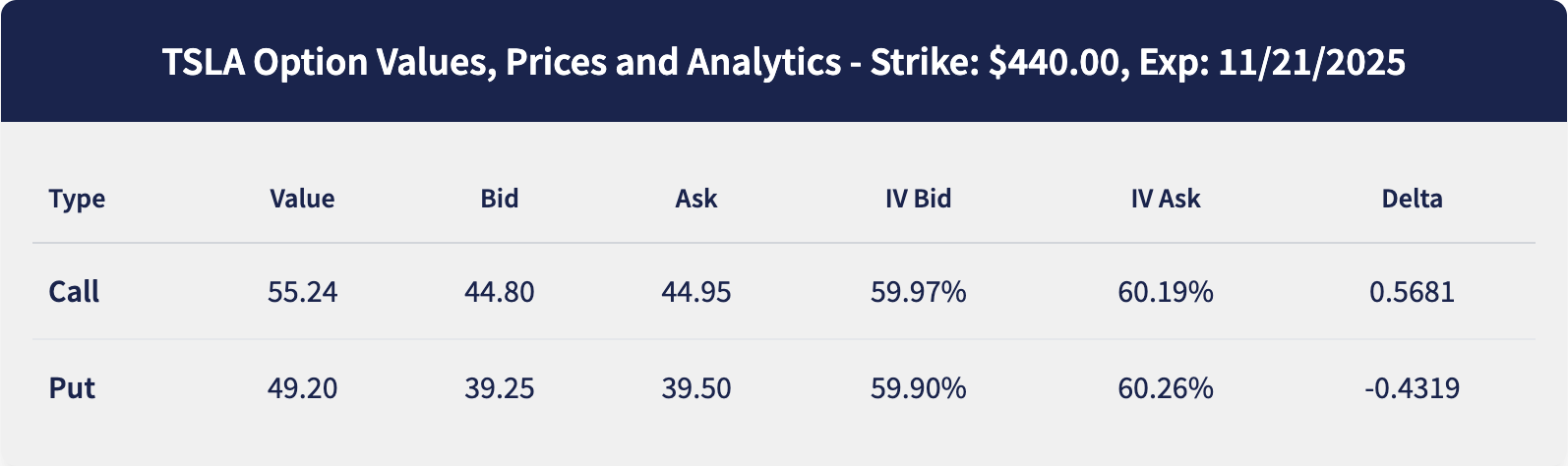

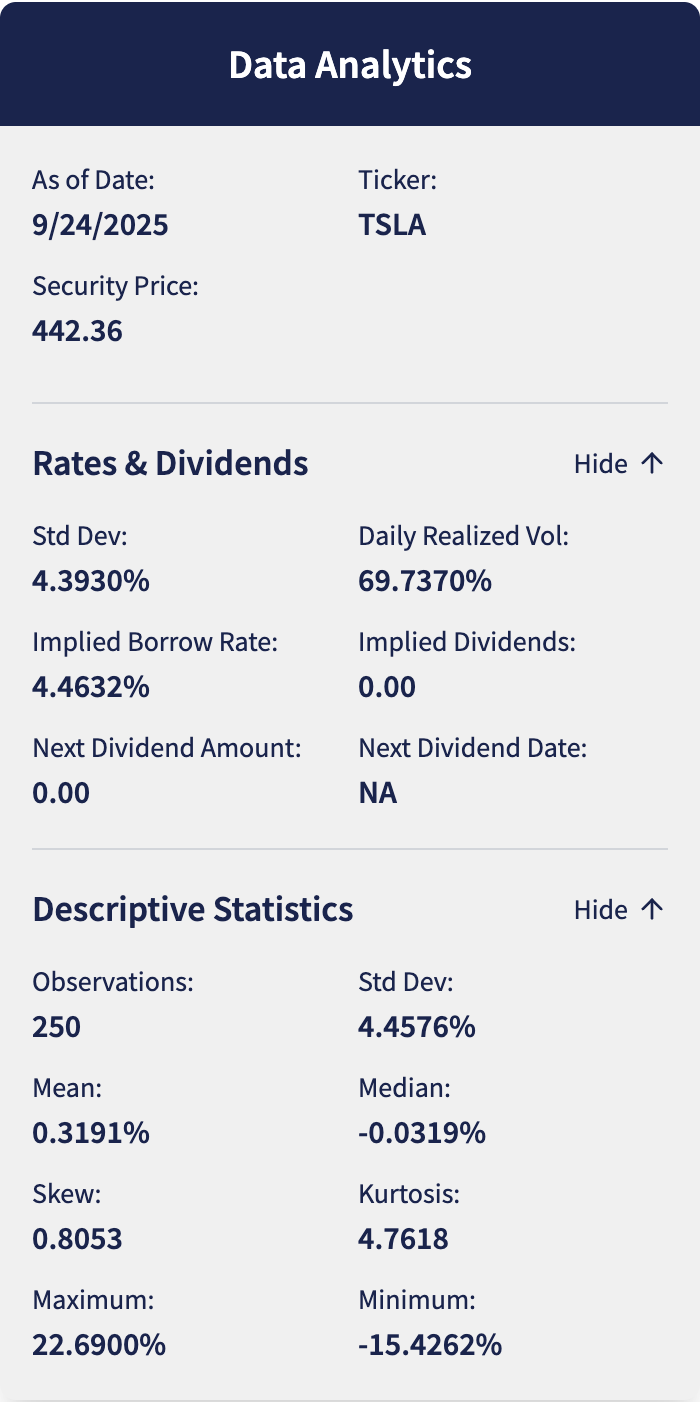

Option Values Based on Real Market Prices

Comprehensive Analytics

Smarter Probability Fuels Bigger Profits

Whether it's identifying hidden risk, measuring market expectations, or valuing options with better precision based on what happens in the real world, ODDS provides analytics that will improve your results.

Define Expectations

What are traders thinking? How are they positioned? Optimize your market knowledge with a visual and quantitative assessment in an instant.

Reduce Risk

Don't let unpredictable moves shock your portfolio. Shine a light on risk that's hidden by outdated one-size-fits-all models.

Start Using ODDS Analytics Today

Join Our Fast Growing Community of Traders Boosting Their Results with Better, Smarter ODDS