The World’s Most Successful Option Trading Firm: “Always Start with Figuring Out How to Instantly Find the Correct Price1”

Successful pros know that to win you need to know what an option is worth. That process always starts with finding the right price.

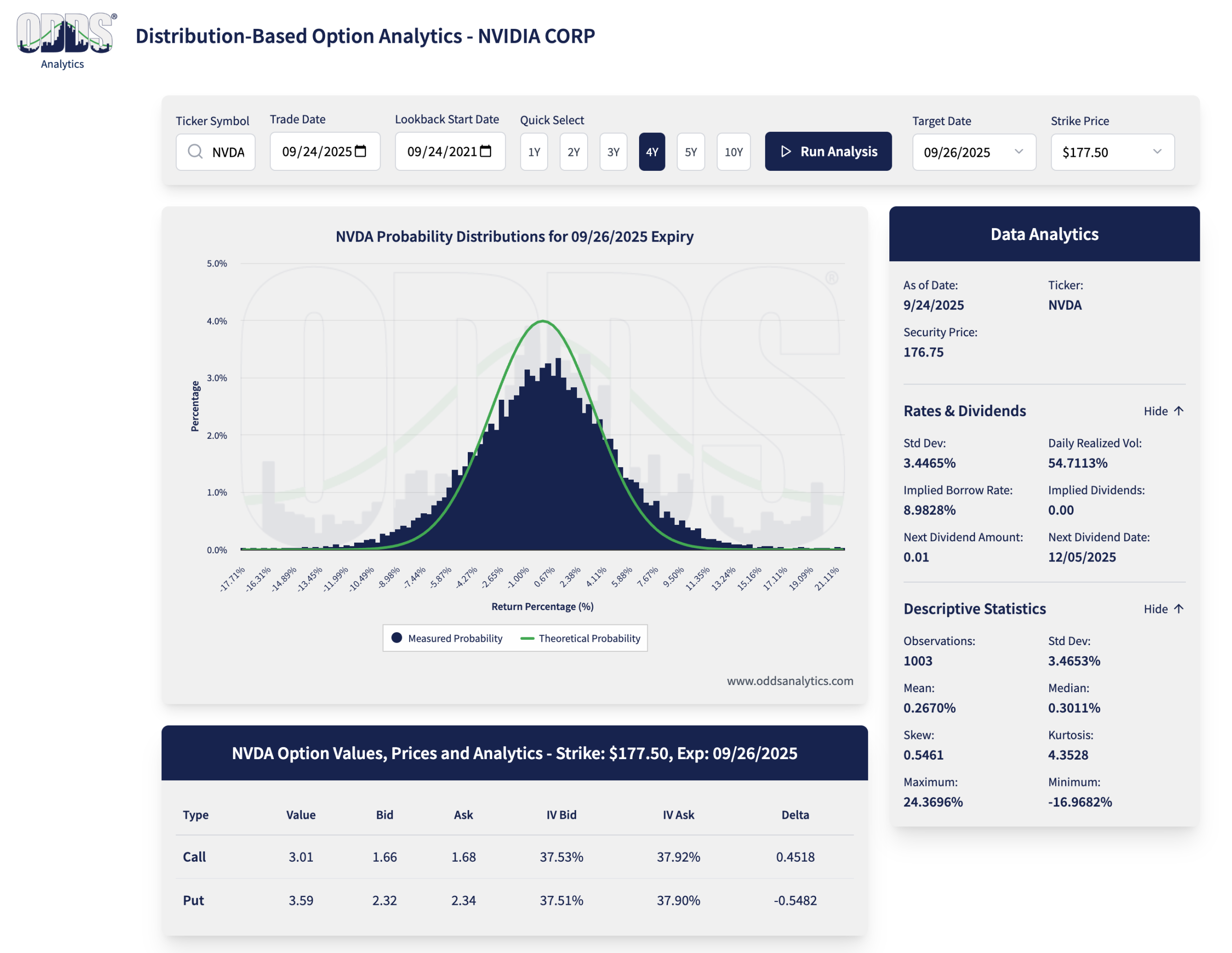

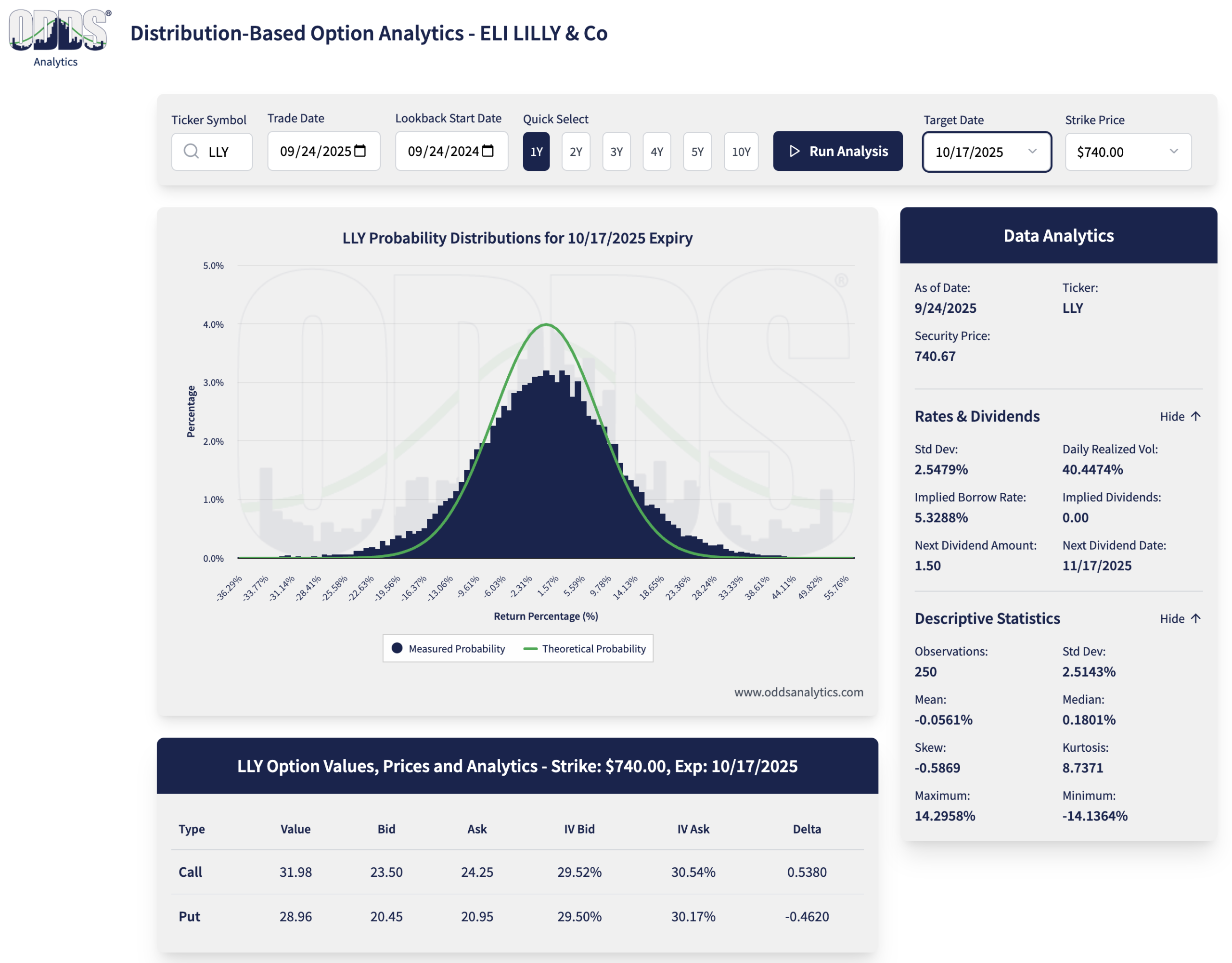

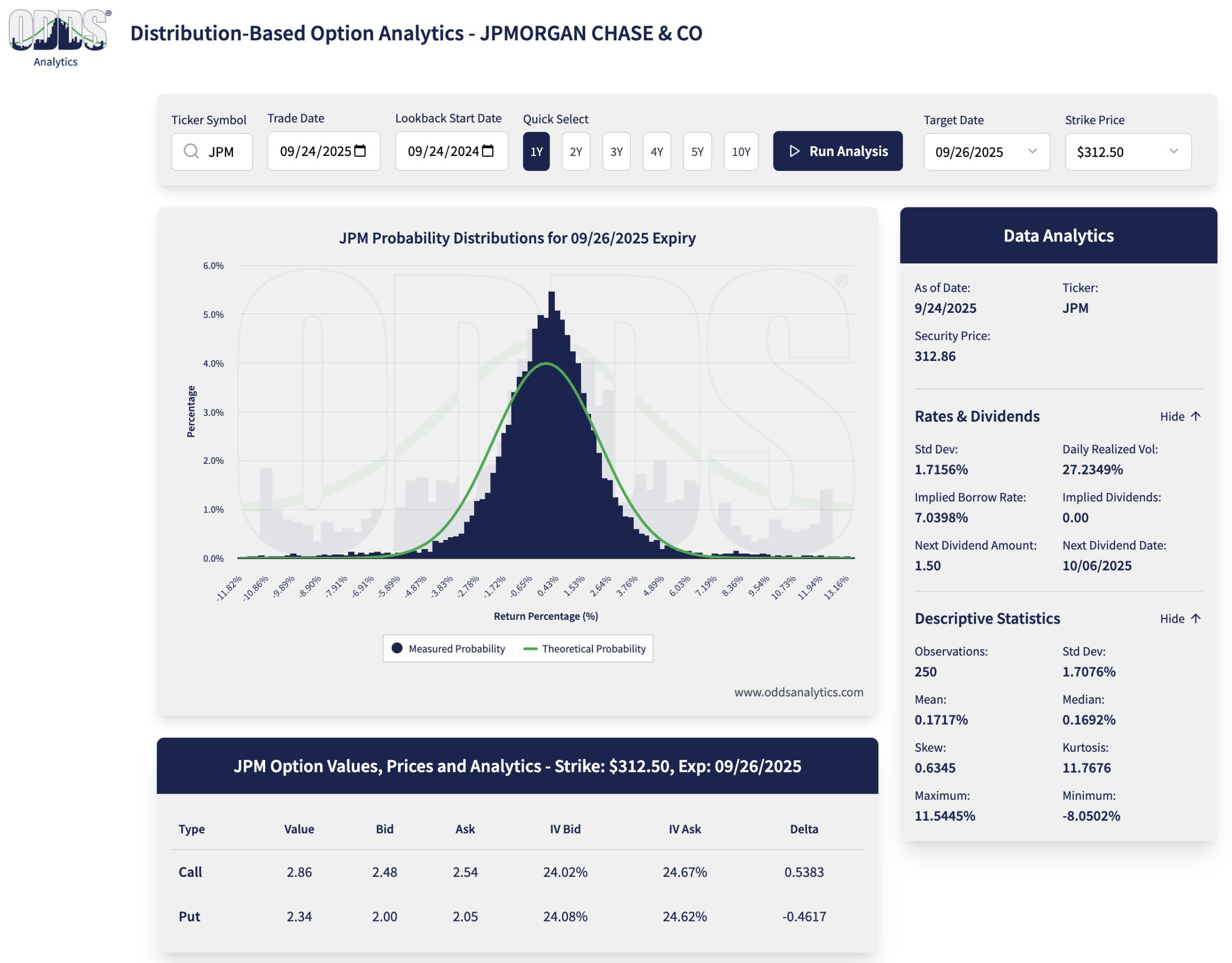

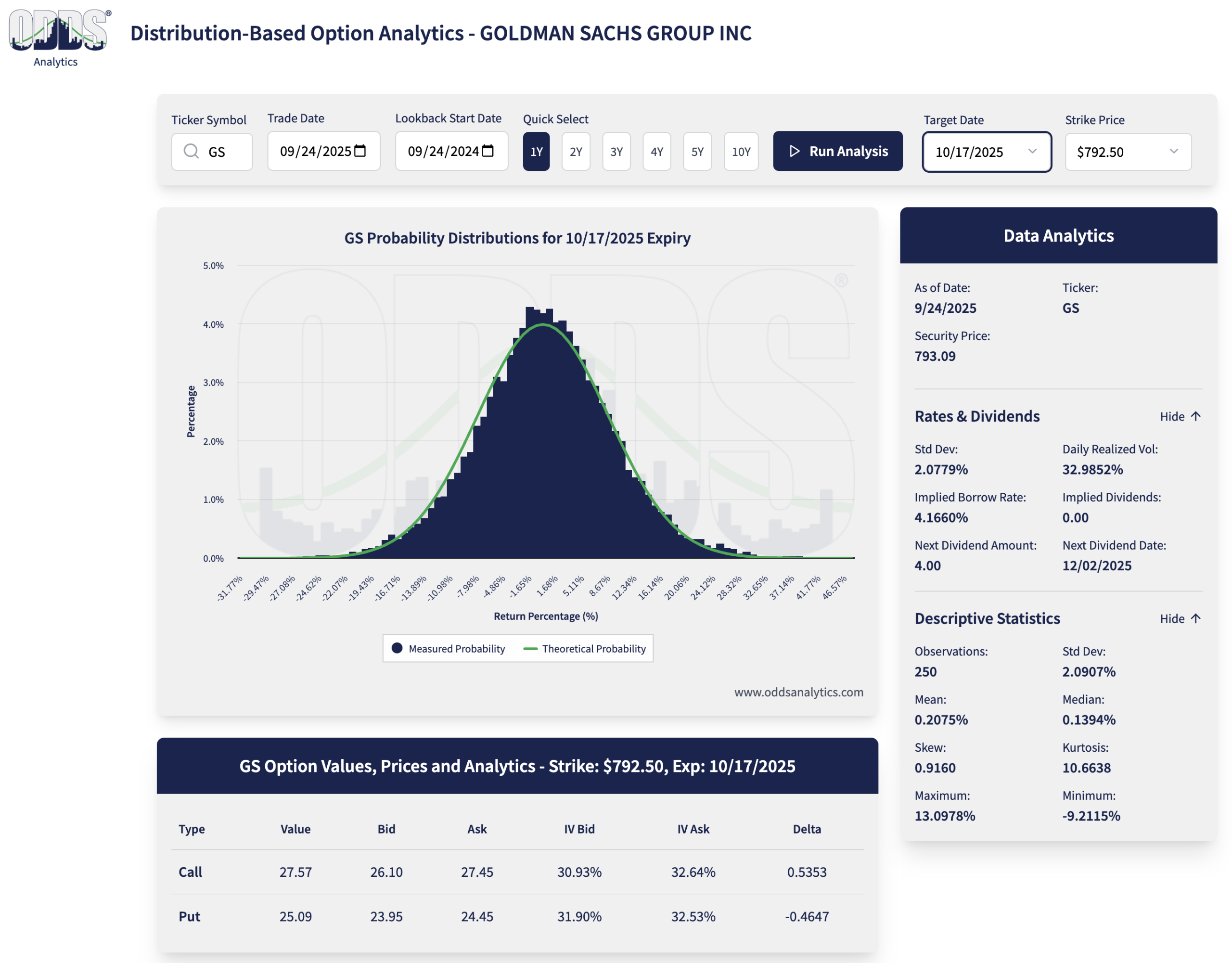

ODDS Analytics finds the correct price instantly. We eliminate unrealistic assumptions found in one-size-fits-all models by creating a probability distribution based on actual movement. We then use that probability distribution to calculate option value, which tells you what an option is truly worth, so you know what you should be trading.

Just $6.99 per month

The Probability Distribution IS the Price

When it comes to options, the Probability Distribution determines the Price. So it’s critical that you get the most accurate picture of how a stock really moves, as opposed to a sanitized, over-optimized theoretical model that depends on unrealistic assumptions.

Introducing the world’s first and only analytical tool that provides investors realistic option values based on each stock’s distinct probability distribution. Get the method that gives investors a true picture of how each individual stock, index and ETF behaves, and the value of every option’s worth.

Data-Driven Probability and Valuation

Tailored to the Individual Security

Generate probability distributions for every underlier and for every time period using the actual price action of the underlier, while your competition uses one-size-fits-all formulas with unrealistic assumptions that fail when it matters most.

Discover opportunities that are only revealed when the analysis is “tailored to the individual” security.

Get accurate, specific probability and valuation based on the way the underlying really behaves.

Identify unexpected risk that may not be revealed using a one-size-fits-all model.

Get Facts, Not Assumptions

Whether you are aware of it or not, options are a probability bet. That means it’s critical to have an accurate probability assessment when valuing puts and calls. The problem is, most option pricing formulas rely on one-size-fits-all models, which is “inherently wrong”. ODDS Analytics is the only method that gives you accurate option values based on specifically tailored probabilities for every stock, every time period, on a case-by-case basis.

Markets have never followed idealized mathematical models. Stop relying on option analytics that lock you into one-size-fits-all formulas.

Complex models add layers of difficulty and require impossible parameters. They tend to fail in the real world, especially when it matters the most.

1 - Doherty, Katherine. “Ken Griffin’s Hand-Picked Math Prodigy Runs Market-Making Empire.” Bloomberg, https://www.bloomberg.com/news/articles/2023-05-11/ken-griffin-s-hand-picked-math-prodigy-peng-zhao-runs-market-making-empire.

Option Values Based on the Way Stocks Really Trade

Join Our Fast Growing Community of Traders Boosting Their Results with Better, Smarter ODDS